47+ how much should my mortgage be based on income

Get Terms That Meet Your Needs. Ad Compare Mortgage Options Get Quotes.

Income Needed To Buy A House Can You Afford One Spendmenot

Remember to include property taxes homeowners.

. Ad The Best Way To Find Compare Mortgage Loan Lenders. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Your income exceeds 1100 and includes more than 350 of unearned income such as interest or dividends.

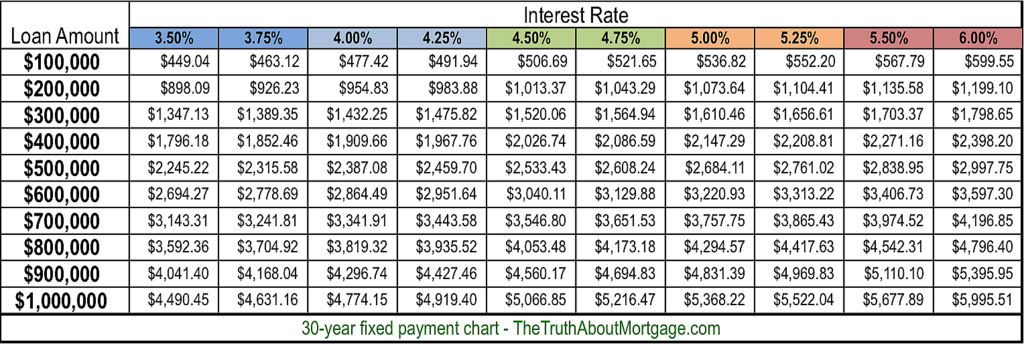

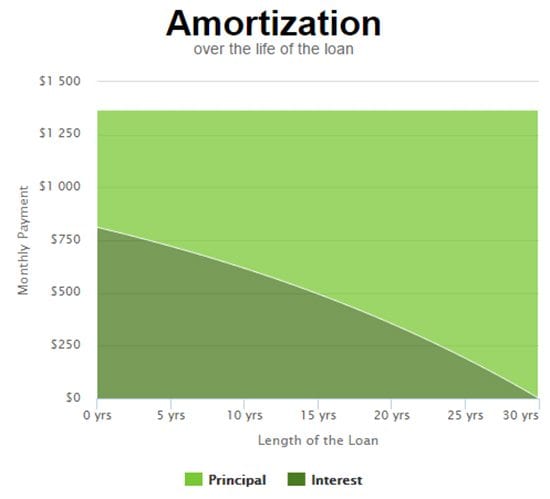

Web Most home loans require at least 3 of the price of the home as a down payment. Web A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Get Started Now With Quicken Loans. Comparisons Trusted by 55000000.

Get The Service You Deserve With The Mortgage Lender You Trust. 2 cash reserves to cover your down payment and closing costs. Web The rule of thumb is that you can afford a mortgage where your monthly housing costs are no more than 32 of your gross household income and where your total debt load.

However how much you. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

Web If paying a mortgage would mean your total monthly spending on paying down debt is higher than 36 percent of your income you may have trouble getting approved for the. Ad Find How Much House Can I Afford. Web A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income on your monthly mortgage payment.

Web Key factors in calculating affordability are 1 your monthly income. 3 your monthly expenses. Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Find Out If You Qualify Now. Ad 5 Best Home Loan Lenders Compared Reviewed.

Web Now you know you can only afford a new home if the total monthly payment comes out to 1150 or less. Ad Looking For Reverse Mortgage Calculator. Some lenders for example indicate that a homes sale price should not exceed.

It is a loan and you must be 62. Some loans like VA loans and some USDA loans allow zero down. Web Rules vary for how much house you should buy based on a your yearly income.

Back-end DTI adds your existing debts to your proposed mortgage payment. Get Your Estimate Today. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

You can find this by multiplying your income by 28 then dividing. Looking For Conventional Home Loan. Looking For Conventional Home Loan.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Although its a myth that a.

Web Most home loans require a down payment of at least 3. Get Competitive Rates That Work Within Your Budget. Backed By Reputable Lenders.

Get The Best Estimate Of Your Loan With A Reverse Mortgage Calculator. Comparisons Trusted by 55000000. For a 250000 home a down payment of 3 is 7500 and a down.

Ad 5 Best Home Loan Lenders Compared Reviewed. Compare Lenders And Find Out Which One Suits You Best. Web Your housing payment shouldnt be more than 2170 to 2520.

Compare Lenders And Find Out Which One Suits You Best. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Keep in mind that this exemption only applies to.

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much House Can I Afford Affordability Calculator Nerdwallet

How Much House Can I Afford Home Affordability Calculator Hsh Com

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

How Much Mortgage Can I Afford Tips For Getting Approved For The Largest Loan Possible Investor S Business Daily

How Much Home Can You Afford Www Hudhomenetwork Com

Mortgage Calculator Enter Your Income See Your Home Price Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How Much Mortgage Can I Qualify For In Nyc Hauseit

How I Make 3000 Per Month Or More Blogging What Mommy Does

.jpg)

10 Tips To Get The Right Home Loan Offers Axis Bank

How Much House Can I Afford Affordability Calculator Nerdwallet

The Income Required To Qualify For A Mortgage The New York Times

How Much Can I Borrow Mortgage Calculator Which

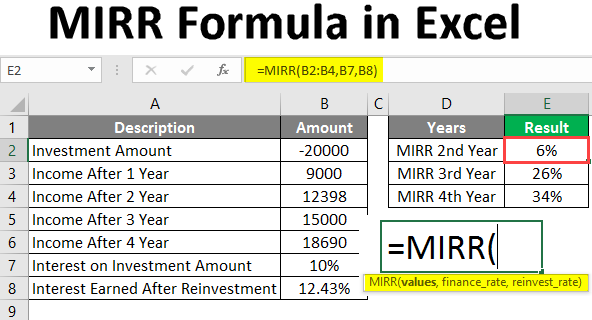

Mirr Formula In Excel How To Use Mirr Function With Examples

Mortgage Income Calculator Nerdwallet

Houses For Sale In Rathmalana 47 House Lk

Mortgage Broker Subiaco Trigg North Beach Scarborough Mortgage Choice